Interest Calculator & Finance Manager

- Size: 4.00M

- Versions: 1.8

- Updated: Nov 04,2024

Introduction

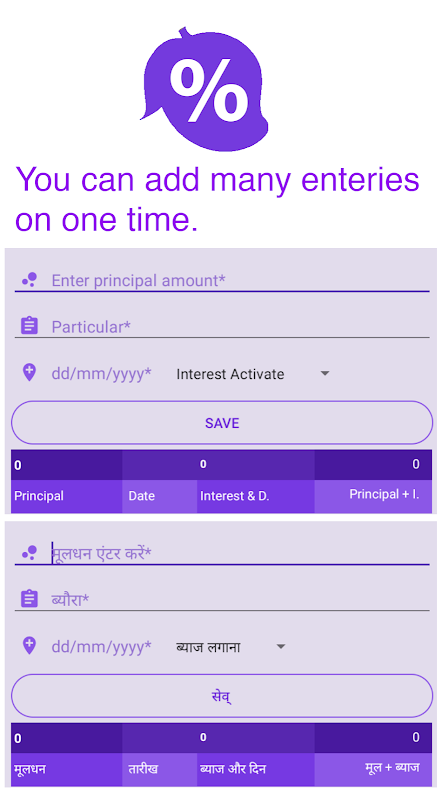

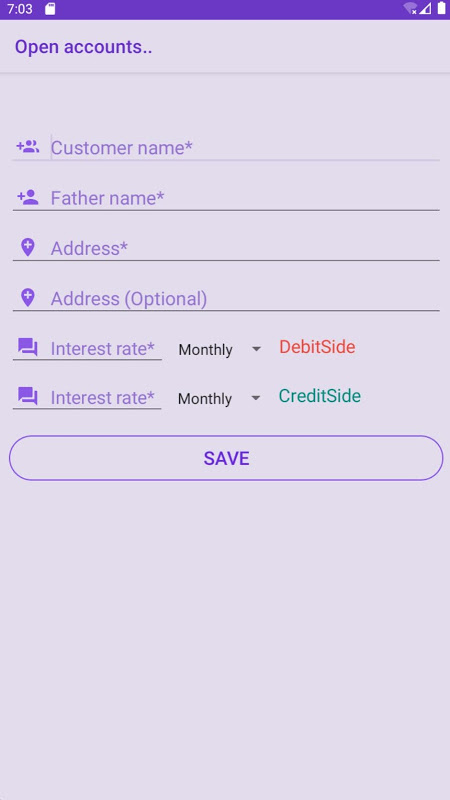

With the Interest Calculator & Finance Manager app, managing your finances has never been easier. This daily interest calculator allows you to calculate interest on a monthly or annual basis, based on the date you open the app. It offers a wide range of features to help you stay on top of your accounts, including the ability to handle multiple interest accounts at once. You can store both debit and credit entries, and the app provides various functions such as viewing, editing, and deleting entries. Say goodbye to financial confusion and start using the Interest Calculator & Finance Manager app today.

Features of Interest Calculator & Finance Manager:

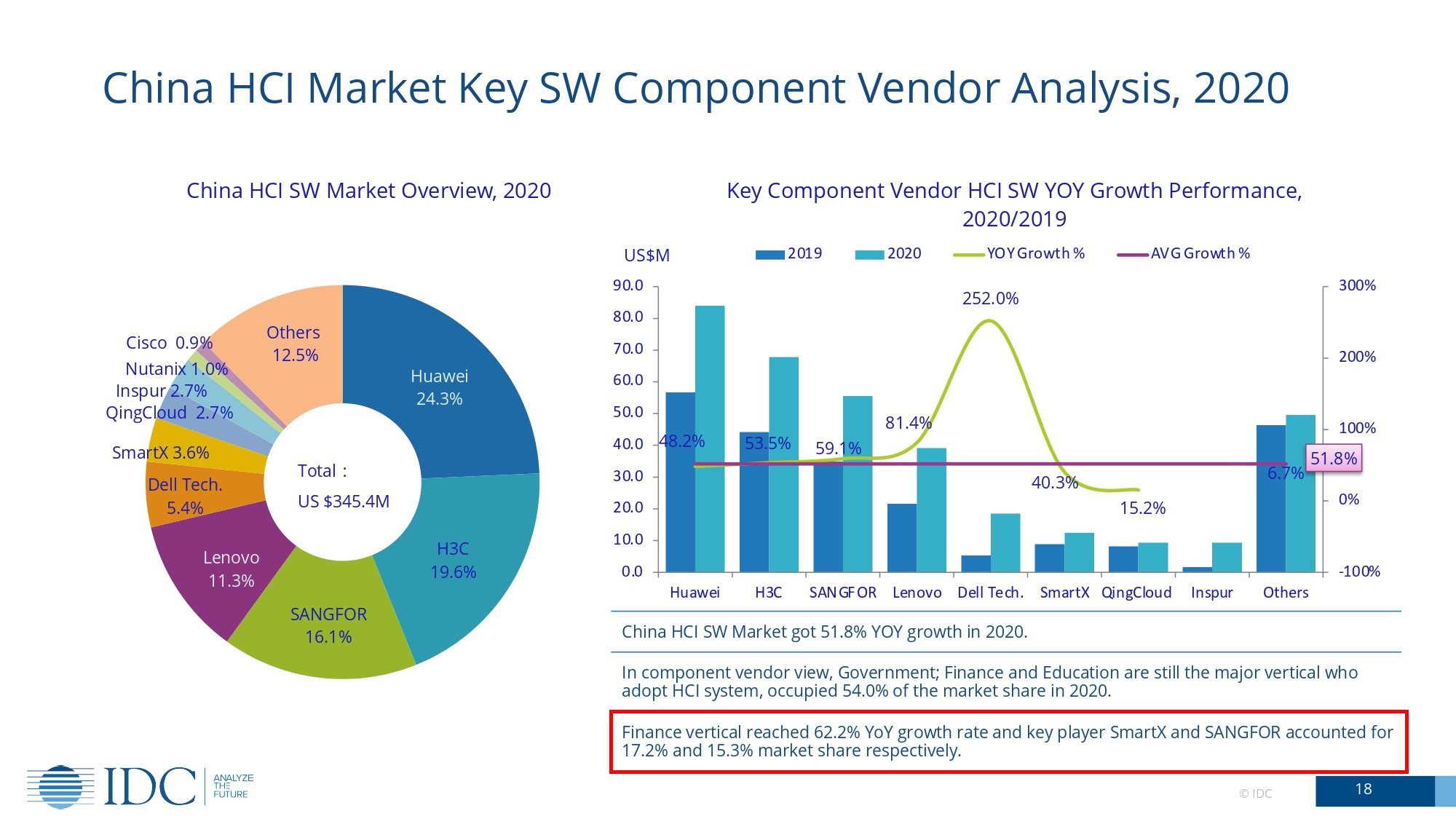

- Daily, Monthly, and Yearly Interest Calculation: This app allows users to easily calculate interest on a daily, monthly, or yearly basis. Whether they want to know the interest earned on their savings account on a daily basis or calculate the interest on their mortgage over a year, this app has them covered.

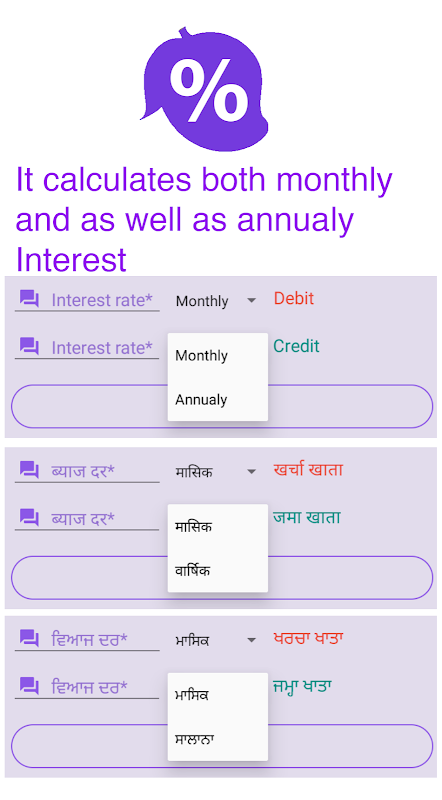

- Multiple Interest Accounts: Users can keep track of multiple interest accounts within the app. Whether they have savings accounts with different banks or multiple loans with varying interest rates, this app can handle it all. It provides a convenient way to manage and monitor all their interest accounts in one place.

- Debit and Credit Entries: The app allows users to make both debit and credit entries. They can easily add and track any interest deposits or withdrawals they have made. This feature ensures that users have a comprehensive record of all their financial transactions.

- Manipulator Functions: In the main account, the app offers several manipulator functions to further enhance the user's experience. Users can view, edit, delete, activate, and deactivate interest entries with ease. This flexibility allows users to have complete control over their interest calculations and management.

Tips for Users:

- Utilize the Daily Basis Interest Calculation: By taking advantage of the daily interest calculation feature, users can have a more accurate understanding of their financial situation. They can track their interest earnings or expenses in real-time, helping them make informed decisions.

- Organize and Categorize Interest Accounts: To keep things organized, users should categorize their interest accounts. They can create separate categories for savings accounts, loans, or any other type of interest-bearing accounts they have. This will make it easier to navigate and manage their financial data within the app.

- Set Reminders for Interest Entries: Since the app works on the basis of the date it is opened, users can set reminders to open the app regularly and log their interest entries. This will ensure that their calculations are accurate and up to date, providing a clearer picture of their financial standing.

Conclusion:

Whether users want to keep track of their savings account interest or manage their loan repayments, this app provides the necessary tools to make informed financial decisions. By utilizing the daily basis interest calculation feature and taking advantage of the manipulator functions, users can have complete control over their interest calculations. Don't miss out on the opportunity to simplify your financial management - download the Interest Calculator & Finance Manager app today.

Information

- Rating: 4.5

- Votes: 346

- Category: Finance

- Language:English

- Developer: Learn-Process

- Package Name: com.learnprocess.interestwhenopenfree

You May Also Like

Finance

-

Emaar One

Size: 49.30MB

Download -

Agbit

Size: 7.50MB

Download -

Moov Money Togo

Size: 9.50MB

Download -

MyCAP Power Broker

Size: 75.40MB

Download -

Euronews - Daily, live TV news

Size: 15.70MB

Download -

Daybook

Size: 10.00MB

Download

Recommended

More+-

Cemig Atende

Cemig Atende

Experience the convenience of managing your electricity services with just a few taps on your phone with the Cemig Atende app. From paying bills with Pix to requesting reconnections and reporting power outages, this app offers a range of features to streamline your interactions with Cemig. Keep track of your account details, payment history, and more, all in one place. With a user-friendly interface and enhanced performance, the Cemig Atende app provides a secure and efficient way to handle your Cemig account anytime, anywhere. Download the app now and discover the ease of managing your electricity services on the go!

-

TMLTH Group

TMLTH Group

Stay connected with TMLTH Group's Group Insurance App to access all your policy-related needs in one place. From checking policy information to viewing claim history, you can easily manage your insurance on-the-go. With convenient features like online claim submission and E-Card access, everything you need is right at your fingertips. Earn Tokio Points and enjoy exclusive privileges as you take steps towards a healthier lifestyle, all while monitoring air quality in your area to make informed decisions about your health. Join campaigns, track your progress, and stay motivated with Google Fit integration. Take control of your insurance and well-being with our user-friendly app today.

-

Timecard GPS

Timecard GPS

Managing a workforce of field workers and mobile employees can be a challenging task for any employer. Luckily, Timecard GPS is here to simplify the process. This mobile application allows field workers to easily log time, attendance, jobs, tasks, breaks, and more from their mobile devices. With GPS tracking and real-time job information available to management on Econz's web-based software, companies can increase productivity, decrease time-theft, and manage their workforce more efficiently. With over 20 custom reports, integration with accounting and payroll packages, and a 30-day money back guarantee, Econz Timecard is the solution to streamline your company's time and attendance needs.

-

Hexnode UEM

Hexnode UEM

Hexnode UEM is the ultimate solution for managing your Android devices within your enterprise. With this app, your IT team can remotely configure settings, enforce security policies, manage applications, and track device locations all from one centralized hub. You can access app catalogs, send location notes, and view compliance details effortlessly. The kiosk management feature allows you to restrict access to specific apps and functionalities, ensuring security and productivity. With Hexnode UEM, you can customize device settings, manage content effectively, and deploy enterprise apps seamlessly. Get started by entering the server name or scanning a QR code provided by your administrator.

-

EPAM Connect

EPAM Connect

Streamline your EPAM experience with the EPAM Connect app! Say goodbye to time-consuming daily tasks with features like time reporting, sick leave requests, and vacation balance tracking. Stay connected with colleagues by searching for profiles and giving badges for achievements. Easily plan your office visit by booking workspaces, parking spots, and lockers. Enjoy exclusive EPAM benefits and discounts in your area with just a tap. Stay informed with company news, updates, and podcasts all in one place. Not part of the EPAM family yet? Explore job opportunities and benefits for potential EPAMers. Download the EPAM Connect app now and make your workday easier!

-

Cargo.LT

Cargo.LT

Introducing the innovative mobile application, Cargo.LT, a freight and transport exchange platform catering to traders, manufacturers, carriers, and freight forwarders. With a focus on the Baltic States, Western Europe, and Russia, this app showcases 7000-8000 daily offers of loads and 10000-12000 transport services in various directions. Featuring over 15,000 trusted freight forwarders and transport companies from Lithuania, Latvia, Estonia, Russia, and Poland, Cargo.LT ensures efficient and reliable delivery of your cargo to its destination. Streamline your freight and transport needs with this dynamic app, connecting you to a vast network of industry professionals.

Popular

-

127.40MB

-

22.02MB

-

36.60MB

-

52.20MB

-

63.40MB

-

727.70MB

-

8112.40MB

-

910.50MB

-

1012.14MB

VPN

VPN

Comments