Fundaztic

- Size: 1.00M

- Versions: 1.3

- Updated: Sep 14,2024

Introduction

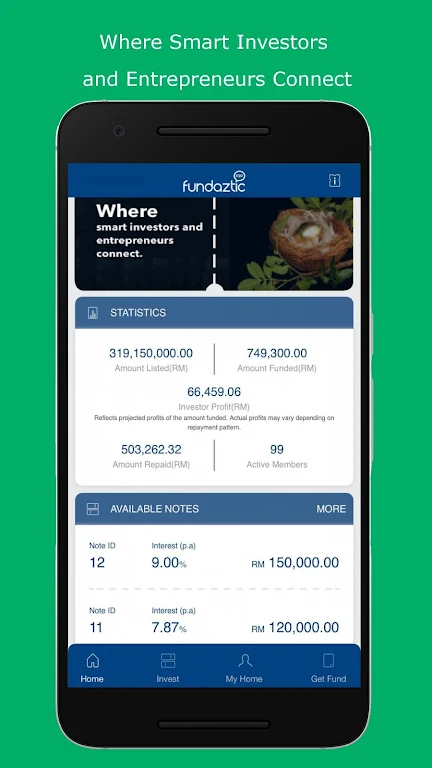

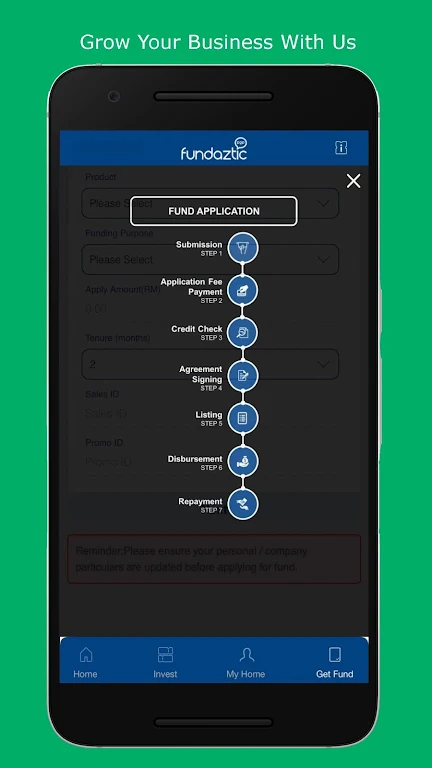

Fundaztic, an innovative peer-to-peer financing platform, is revolutionizing the way businesses and individuals access financing and investment opportunities. With a belief in sustainable and meaningful growth, the app aims to bridge gaps in the ecosystem by leveraging technology to create a transparent and fair online marketplace. Issuers can easily apply for financing through a fast and simple online process, while Investors can diversify their investments across multiple Investment Notes for attractive returns. With a minimum repayment period of 6 months and a maximum of 36 months, the app offers flexibility. Additionally, with an APR ranging from 8.15% to 13.85% per annum, the app ensures competitive rates. Join the app today and achieve your financial goals with ease.

Features of Fundaztic:

Easy and Fast Financing: The app offers a fast and simple online application process, making it easy for businesses to access financing. With a user-friendly interface, borrowers can quickly submit their funding requests and receive a prompt response.

Low Entry Barriers: The app aims to enhance access to financing and investment for both businesses and individuals. The platform has low entry barriers, allowing small businesses and individuals with limited resources to tap into the financial market and expand their opportunities.

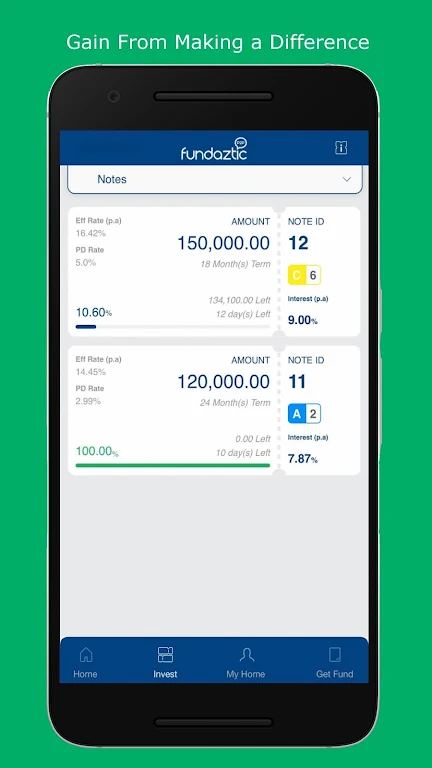

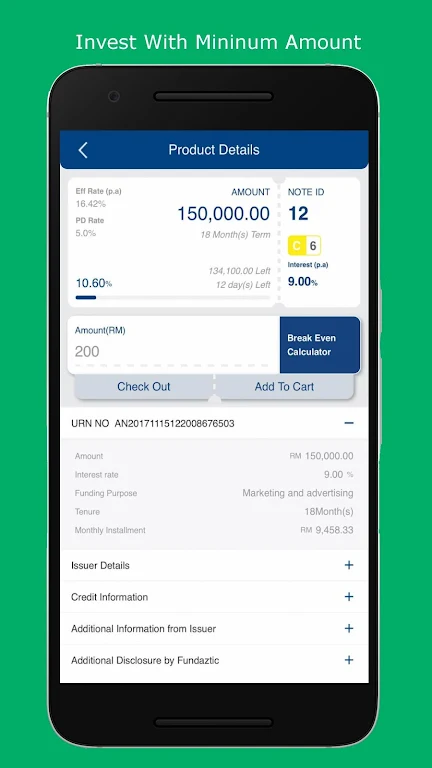

Attractive Returns on Investments: Investors on the app can provide funds to multiple Investment Notes and earn attractive returns on their investments. The platform offers a range of investment opportunities with competitive interest rates, maximizing the potential for investors to grow their wealth.

Transparent and Fair Marketplace: The app is dedicated to transforming the financing ecosystem into a transparent and fair online marketplace. By providing clear information and ensuring fair practices, the platform promotes trust and confidence among borrowers and investors.

FAQs:

What is the minimum and maximum repayment period for funding?

The app offers a flexible repayment period of 6 months (minimum) to 36 months (maximum) for funding. Borrowers can choose a repayment term that suits their financial needs and capabilities.

What is the maximum Annual Percentage Rate (APR)?

The maximum Annual Percentage Rate (APR) on the app ranges from 8.15% to 13.85% per annum. The specific APR for each funding request is determined based on factors such as creditworthiness and loan term.

Conclusion:

Fundaztic offers a user-friendly platform that makes financing accessible to businesses and individuals. With a fast and simple online application process, borrowers can easily apply for funding and receive a prompt response. Investors can take advantage of the attractive returns on investment by providing funds to multiple Investment Notes. The platform is committed to transparency and fairness, creating a trustworthy marketplace for both borrowers and investors. With flexible repayment periods and competitive interest rates, the app aims to help businesses and individuals achieve their financial goals.

Information

- Rating: 4.3

- Votes: 319

- Category: Finance

- Language:English

- Developer: Peoplender Sdn. Bhd.

- Package Name: com.peoplender.fundaztic

You May Also Like

System

Recommended

More+-

JumpCloud Protect

JumpCloud Protect

Simplify your work login process with the award-winning JumpCloud Protect® mobile app. Say goodbye to security concerns with multi-factor authentication (MFA), offering advanced user verification with either push notifications or time-based one-time passwords (TOTP). No more worrying about weak passcodes or unreliable SMS codes - MFA provides an extra layer of protection that is both user-friendly and secure. With TOTP, you can authenticate without needing a Wi-Fi or cellular connection on your device. Experience a seamless and safe login experience with JumpCloud Protect®, the trusted choice for secure work resource access.

-

e-TOLL PL

e-TOLL PL

Simplify your travel on toll roads in Poland with the user-friendly e-TOLL PL app. Just start your journey in the app, and pay seamlessly with your smartphone or tablet. Plus, if you're involved in the transport of goods that fall under the Electronic Transport Supervision System (SENT), take advantage of the convenient journey monitoring feature within the app. With e-TOLL PL, traveling through toll sections of national roads has never been easier. Say goodbye to long waits and complicated payment methods – download the app today and hit the road with ease.

-

FatturAE

FatturAE

FatturAE is a powerful app designed for users with a VAT number who are self-employed, sole traders, professionals, or appointees of PNF entities. With FatturAE, you can easily create, manage, and send electronic invoices in various formats such as Ordinary Invoices and Simplified Invoices. The app provides customizable templates like Fuel Invoice and Invoice for flat rate regime to streamline the invoicing process. You have the flexibility to sync your invoices to the cloud at your convenience, while always having access to stored XML format invoices on your device. For additional services like Consultation and Conservation, simply access the Invoices and Fees Portal from any mobile device. FatturAE simplifies invoicing for busy professionals on the go.

-

Position Size Calculator

Position Size Calculator

Are you tired of guessing how much of a stock or asset to buy when trading, only to end up with unexpected losses? Well, say goodbye to all your worries with this amazing calculator app! Position Size Calculator is a game changer in the trading world, as it helps you determine the perfect quantity to buy based on your desired level of risk. Not only does it calculate the trading quantity, but it also tells you exactly how much risk you'll be taking on per share in each trade. With a user-friendly interface, lightning-fast calculations, and absolutely no ads, Position Size Calculator is a must-have for any serious trader. Get it now and take control of your trades like never before!

-

State Street Bank

State Street Bank

Manage your finances seamlessly with the State Street Bank app. This powerful tool allows you to stay on top of your transactions by adding tags, notes, and photos, while also providing alerts for low balances. Easily make payments, transfer money between accounts, deposit checks with a simple snapshot, and access your monthly statements all in one place. With the added convenience of locating branches and ATMs near you, this app ensures your financial needs are met quickly and efficiently. Secure your account with a passcode or biometrics for peace of mind. Experience the ease of managing your finances with the State Street Bank app today.

-

App Digital Sign

App Digital Sign

Easily add digital signatures and timestamps to your files with App Digital Sign. This handy app from Namirial S.p.A. ensures the authenticity of your documents while providing the peace of mind that your digital signatures are valid. Simply select the files you want to sign or timestamp, input your credentials provided by Namirial S.p.A., and complete the desired operation. With just an internet connection and a file on your device, you can certify the content of your documents in no time. Rest assured that your files are secure and signed by you with the added security of a One Time Password (OTP) for digital signatures.

Popular

-

127.40MB

-

22.02MB

-

36.60MB

-

52.20MB

-

63.40MB

-

727.70MB

-

8112.40MB

-

910.50MB

-

1012.14MB

VPN

VPN

Comments